Chinese panel manufacturers actively enter the IT panel field to promote the recovery of LCD factory investment

2022-01-11

Key Points

TV panels sold very well during the global COVID-19 pandemic, but it was the IT sector that was more popular in the market. Further, with the evolution of the IT industry, the so-called IT (Information Technology, information computer industry) panel demand is evolving to the IoT (Internet of Thing, Internet of Things) panel demand.

Global laptop and tablet panel sales have nearly doubled from $14.6 billion in 2019 to $28 billion in 2021.

In addition to BOE, by far the world's largest FPD producer, the Chinese mainland manufacturer's IT panel market share is far lower than its TV panel share, far behind Taiwan manufacturer and LG Display. So mainland Chinese manufacturers see a big opportunity to diversify their product portfolio away from their heavy reliance on the TV market, which will help mitigate the extremes of the crystal cycle and take share from competitors.

With the shift in capacity allocation in many Chinese mainland factories, the expansion of incremental capacity, and the construction and planning of new factories targeting IT panels, interest in the market and technological evolution of IT panels has increased significantly.

New LCD factories that have already ordered equipment will almost certainly be built as planned, while China's IT panel production will continue to increase in the coming years. This will help mainland Chinese manufacturers diversify their businesses, but it also raises concerns about overproduction of IT panels.

Not long ago, some media quoted China's major panel manufacturers as saying that after building a large number of 8.5/8.6 generation line and 10.5 generation line LCD factories for TV applications, "no longer invest in LCD". Recently, however, predictions for new factory investment in China are shifting from OLED for smartphone applications to LCD, especially for IT production.

From mid -2020 to mid -2021, a surge in demand driven by the new crown epidemic turned the oversupply of large-size LCDs in 2019 into a shortage, while also pushing panel prices and panel manufacturers' profits to all-time highs in the first half of 2021. Even though the TV panel market is clearly on a downward trend, the super-cycle of the past year has affected the actual and planned investment strategies of panel manufacturers.

TV panels sold well during the epidemic, but the IT sector is more popular in the market, and the current IT panel application has gradually integrated with the so-called IoT (Internet of thing, Internet of Things) megatrend, and it will continue to outperform the overall panel market. For example, sales of laptops and tablets nearly doubled from $14.6 billion in 2019 to $28 billion in 2021 (see Figure 1).

Figure 1: Notebook and Tablet Panel Sales Amount

Source: Omdia

In terms of area, demand for laptops and tablets has expanded from 16.3 million square meters in 2019 to 23.2 million square meters in 2021. Omdia predicts that the amount of panel sales will decline moderately as panel prices begin to decline from 2022 onwards. Even so, with the accelerating shift to mobility in the workplace and more and more online education, sales will remain above pre-pandemic demand in the future. In terms of area, demand is expected to continue to grow year on year. Driven by the same market trends, the growth path of demand for desktop display panels is very similar to that of laptops and tablets.

Further, with the evolution of the IT industry, the so-called IT (Information Technology, information computer industry) panel demand is evolving to the IoT (Internet of Thing, Internet of Things) panel demand, which represents more opportunities and challenges.

The outstanding performance of the IT panel market has aroused great interest from all FPD panel manufacturers, especially those in mainland China. With the exception of BOE, by far the world's largest FPD producer, the IT panel market share of Chinese mainland manufacturers is much lower than its TV panel share, far behind Taiwan manufacturers and Lejin display (see Figure 2).

Figure 2: Share of laptop panel shipments, 2021

Source: Omdia

The market growth has attracted the attention of mainland Chinese panel manufacturers, who see it as a great opportunity to diversify their product portfolio away from their heavy reliance on the TV market, which will help ease the extremes of the crystal cycle, and to take share from competitors.

With the shift in capacity allocation in many Chinese factories, the expansion of incremental capacity, and the construction and planning of new factories targeting IT panels, interest in IT panel sales has increased significantly.

Figure 3: Schedule of confirmed and under consideration FPD plants in China and India, 2021-2024

Source: Omdia

Note: The Gantt chart above only shows the timing of the first phase, total capacity or ramp capacity by the end of 2026. It does not include plants built before 2021, but includes those that expand after. In Omdia's methodology, only plants with a probability of ≥ 30% are counted in the forecast of supply and equipment. See Omdia's 3Q21 OMDIA OLED and LCD Supply Demand & Equipment Tracker for more details and latest forecasts. Of the 13 factories shown in Figure 3, more than half are producing LCDs. Huaxing T9, Huaxing T5, Tianma TM19, Xinli Sichuan No. 3 factory and BOE B15 new factory will be dedicated to IT panel production. At the same time, the planned Huike H6, Visino V4, Huaxing T8 and Vedanta VED 1 Plant in India all plan to allocate some capacity to IT. The two new factories of Huaxing Optoelectronics, T9 and T5, are now planned to be fully dedicated to IT production and are advancing rapidly. Other plants listed for 2023 and beyond are speculative, though.

From the third quarter of 2020 to the third quarter of 2021, Chinese panel manufacturers have reaped huge returns on their investment in LCD factories, as brand owners have been unable to purchase enough panels to meet their stated demand and panel prices have soared. At the same time, Chinese manufacturers look at the utilization and profit margins of their LCD and OLED factories, and clearly see that their LCD factories are more productive and profitable. This, in turn, has led to multiple new LCD factory plans, and at least in the case of the Huaxing Optoelectronics T5 plant, the company can be seen shifting its planned OLED plant to LCDs.

This reappears the prospect of future investment in LCD factories, once again proving the versatility and staying power of mainstream LCDs. This also marks a significant investment by Chinese manufacturers to gain market share in the IT panel sector.

With the industry now past the epidemic super-cycle, panel prices are starting to fall and the market, financial and political environment has become less favorable. Panel manufacturers may again shift or even cancel some investment plans. In any case, the factories that have already ordered the equipment will almost certainly be built as planned, and China's IT panel production will continue to increase in the coming years. This will help Chinese manufacturers diversify their business, but it also raises real concerns about overproduction of IT panels.

Depending on the scale of this production surge, the current stable IT market may suffer from greater competition and lower prices, putting pressure on current market leaders and making the field less attractive to new players themselves than they originally expected.

Industry Information Daily

2021-09-13

LCD TV panel prices are falling sharply: LCD TV panel prices have been soaring for more than a year, but a downward trend began in the third quarter of 2021.

-- This article is from Omdia

LCD TV maker to face sharp drop in panel prices in second half of 2021 after surge in supply chain costs

Release date: 2021/8/31

Source: Omdia

Abstract:

The price of LCD TV panels has been skyrocketing for more than a year, but a downward trend began in the third quarter of 2021. Prices are falling sharply.

Whenever there is a clear signal of a downward trend in panel prices, the display panel supply chain participants fall into a vicious circle. TV makers are lowering their panel purchase forecasts. The major panel price adjustment originally expected to occur in the first half of 2022 has been advanced to the second half of 2021.

The plunge in panel prices in the second half of 2021 was mainly driven by competition among TV manufacturers; the widening difference in interest rates between Chinese TV manufacturers and South Korea TV manufacturers, coupled with the strong bargaining power of dual-Korean TV brand manufacturers in the supply chain, accelerated the decline in LCD TV panel prices.

LCD TV panel prices are falling sharply: LCD TV panel prices have been soaring for more than a year, but they began to decline in the third quarter of 2021.

The plunge in panel prices in the second half of 2021 was mainly driven by competition among TV manufacturers; the widening difference in interest rates between Chinese TV manufacturers and South Korea TV manufacturers, coupled with the strong bargaining power of dual-Korean TV brand manufacturers in the supply chain, accelerated the decline in LCD TV panel prices. However, the rapid decline in panel prices is not what first-line TV manufacturers are happy to see. How do TV manufacturers take up the risk of plunging TV monitor prices and maintain the competitive landscape changed by the tight supply chain of first-line manufacturers in the past year-good money drives out bad money and the opportunity to increase the value of the TV supply chain-this will test how TV monitor supply chain participants should adjust their operations and competitive strategies, with the increasing difficulty of forecasting the future of supply chains and televisions, it is the common goal and responsibility of all participants to achieve sustainable management.

LCD TV panel prices have been soaring for more than a year; the decline began in the third quarter of 2021, with a large and fast decline

At the beginning of the third quarter of 2021, participants in the TV panel supply chain feel that there is no longer a shortage of LCD panels, and due to global logistics problems and the extremely tight supply of electrical components, TV manufacturers are no longer actively purchasing panels in large quantities, and the bargaining power of the LCD panel supply chain has returned to TV manufacturers.

July 2021 is a crucial month. LCD TV panel prices reversed, and the panel price negotiations. Panel price negotiations include requiring MDF(market development funds) and price protection for some TV manufacturers. This makes panel manufacturers feel more pressure, because TV manufacturers in the third quarter of the panel demand forecast, but also delayed the fourth quarter of the panel purchase order or said that it may significantly reduce the initial purchase plan. As of mid-August, only a few TV manufacturers have finalized the panel price for July. Most TV manufacturers are reluctant to finalize panel prices for July and August before the end of the third quarter of 2021.

The following is Omdia's observation of LCD TV panel price trends, based on a survey of the TV panel industry supply chain in mid-August. Omdia believes that panel prices will fluctuate greatly in the third and fourth quarters of 2021. History may repeat itself-large price adjustments may follow a panel price surge, especially in the early stages of a panel price decline.

• Panel price negotiations have been rocky since July 2021. The back-and-forth communication between panel manufacturers, TV brands/OEMs and retailers will continue until September 2021, covering panel shipments in the third quarter of 2021.

-Overall TV demand in the end market, including developed markets where TV shipments grew in 2020, has been weakening (compared to the unusually strong consumer demand triggered by the new crown epidemic in 2020). Although this is the reason why the panel demand is not so strong, the main reasons for the upcoming panel price correction that may be larger and faster are the following:

• Unbalanced distribution of profits across the TV panel supply chain. When panel manufacturers announce record profits in the second quarter of 2021, this means that the bargaining power of the supply chain may change. Conversely, when panel manufacturers suffer large losses, the signal of a rebound in panel prices will also be evident.

• Panel manufacturers' profit margins soared in 2Q2021. South Korea's first-tier brands made better profits in the second quarter of 2021, but China's TV makers continued to decline in profit margins.

In 2021, larger TV manufacturers will become stronger. When TV manufacturers are urged to accelerate the migration to feature-rich large-size TVs, it is possible to restore a healthy or profitable TV panel business environment. However, in this unprecedented supply shortage, low-end TV machine manufacturers face a major risk of being squeezed.

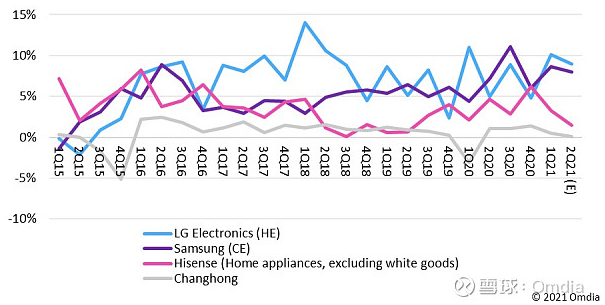

-Compared with the results of the first quarter of 2021, despite the continuous increase in panel prices in the first half of 2021 and other supply chain issues, such as logistics issues and shortages of non-panel TV materials, South Korea first-line brands Samsung and LG Electronics were able to maintain their TV business operating profit margins in the second quarter of 2021 at a level similar to the first quarter of 2021. South Korea brands' profit margins are better than their industry peers due to their strong push to large/oversized migration with advanced TV features, competitive supply chain management of panel pricing and logistics arrangements, and strong brand negotiation ability to bargain with retailers to increase TV average selling prices. Entering the second half of 2021, Samsung and LG Electronics are expected to achieve higher profit margins in the third quarter of 2021, but Chinese TV manufacturers will face greater challenges, as shown in Figure 1. This will prompt Chinese TV manufacturers to more actively require panel manufacturers to provide lower panel prices.

Figure 1: Quarterly Operating Margin of TV Machine Manufacturers (%)

The shortage of non-panel parts, especially electrical parts, has caused TV manufacturers to no longer rush to actively purchase panels in the second half of 2021, because even if they prepare the panels, no parts will be shipped.

Logistics problems-container shortages, container ship jams and soaring transportation costs-have made TV manufacturers and retailers very anxious, which has damaged their supply chain arrangements and profit management to cope with the upcoming, very critical fourth quarter promotion season. Coupled with the supply of electrical accessories and global logistics issues, the production plans of TV manufacturers in the second half of 2021 are being affected.

• TV manufacturers and retailers must pay extremely high prices to ship goods from Asia to North American or European markets. Some people are worried about the upcoming promotion season, because if it cannot reach the end market in time for the holiday promotion season, some goods will end up as hidden inventory, which is risky.

• Omdia expects a sharp and rapid decline in panel prices to begin in the middle of the third quarter of 2021. This allows TV manufacturers to purchase panels more conservatively before the end of the panel price adjustment. As analyzed by Omdia in the TV Panel and OEM Information Services report, Omdia believes that TV manufacturers will reduce their panel purchase forecasts for the third and fourth quarters of 2021.

-TV panel prices are on a downward trend in the third quarter of 2021, so some TV machine manufacturers are eager to clean up their TV goods and inventory and sell them in the market at a lower price to avoid more inventory losses, as these TVs are equipped with high-priced panels. Before panel makers agreed to offer panel price concessions to TV makers, some TV makers were forced to cut their average TV prices further because they found it difficult to boost TV sales-especially in the Chinese market-despite some price cuts in July 2021. This means that TV manufacturers will have to do more promotional activities to drive sales. TV manufacturers will continue to require panel manufacturers to provide more concessions by providing MDF, reducing panel prices and price protection. Alternatively, they will make more cuts in panel purchases in the third and fourth quarters of 2021.

• Whenever there is a clear signal of a downward trend in panel prices, display panel supply chain participants fall into a vicious circle. TV makers and retailers are trying to predict how far panel prices will fall in the current downward cycle. TV manufacturers cannot predict whether the recent surge in panel prices is likely to fall to the lowest price level in history in November 2019 or the low price level in May 2020 of the previous cycle. There are several dynamic changes in the supply base of LCD panels. At present, the most obvious change is the decrease in the number of LCD panel suppliers, and the dominance of Chinese panel manufacturers in panel shipments, product size/function and production capacity.

• TV makers are actively negotiating with panel makers to make big price concessions to compensate for promotions and boost sales, especially in China. TV manufacturers are also pushing panel manufacturers to reduce the average price of panels to improve their financial situation to a certain extent. However, TV manufacturers are also worried about the loss of inventory prices, and the decline in TV panel prices will scare away demand from retailers.

• Omdia expects a sharp decline in panel price trends in 2022, as shown in Figure 2. However, based on the results of a recent supply chain survey conducted in mid-August 2021 on TV maker target panel prices for the third and fourth quarters of 2021, Omdia has begun to notice a sharp change in panel price trends (as shown in Figure 3). This suggests that the panel price correction originally expected in the first half of 2022 has been advanced to some extent to the second half of 2021.

Figure 2: Panel price changes in the first half and second half of 2008-2022, updated July 2021

Figure 3: Panel price changes in the first half and second half of 2008-2022, updated in August 2021 (based on the target price of TV manufacturers in the second week of August 2021)

Chart Description:

1. The price changes in the first half of the historical year are based on the price changes between June and December (for example, the data for the first half of 2008 are price comparisons between June 2008 and December 2007).

2. The price changes in the second half of the historical year are based on the price changes between June and December (for example, the data for the second half of 2008 are the price comparison between December 2008 and June 2008).

3. Before 2012, panel prices were based on CCFL(module cold cathode fluorescent lamps). Starting from January 2012, panel prices are based on open cell.

4. From April 2014, 50-inch UHD became the dominant size in the mid-range size category.

5. Starting from May 2008, the price of 55 inches will be available.

6. Starting from April 2014, 65-inch prices will be available.

SEMI Julong: Global lack of core-accelerated restructuring of semiconductor industry chain layout

2021-06-21

The 2021 World Semiconductor Conference kicked off on June 9. Ju Long, SEMI's global vice president and president of China, delivered a keynote speech on "Global Core Shortage-Accelerated Reorganization of Semiconductor Industry Chain Layout". Starting from the topic of global core shortage, the current international and domestic semiconductor industry status and future development trend are deeply analyzed with detailed data.

Super Cycle with three consecutive years of growth

Since the second half of last year, starting from the shortage of automotive chips, the lack of cores has extended to the entire industry including mobile phones, data centers, consumer electronics, etc., and has even attracted the attention of leaders in many countries. "The lack of production capacity is comprehensive. From advanced nodes to more mature nodes, we even feel the shortage of certain materials." Julong pointed out that in addition to the factors of strong demand and insufficient production capacity, the problem of lack of core also includes the management of the supply chain, the impact and restructuring of the new crown epidemic and the international situation on the industrial chain.

The digital economy and smart applications will continue to drive the growth of the semiconductor market. The latest data show that in the first quarter of this year, the top 15 companies in the semiconductor market as a whole increased by 21% year on year. All IDM, Fabless and Foundry except Intel have generally increased. From the perspective of application fields, applications in various fields including smart phones, automotive electronics/electric vehicles, servers/data centers, PC, AI (artificial intelligence), 5G communications, etc. are all growing in an all-round way, especially memory continues to grow with a strong momentum. "The growth rate of various forecasting agencies is between 15-20%. Although there may be some slowdown in the second half of the year, the milestone of surpassing US $500 billion should be reached this year." Julong stressed that driven by the strong digital economy and intelligent applications, the global semiconductor market will achieve a Super Cycle super cycle of three consecutive years of growth by 2022.

Strong global semiconductor investment, advanced capacity in East Asia, mature capacity to see China

According to the statistics of 12-inch fabs, the number of advanced nodes continues to increase, and the construction of 12-inch fabs is dominated by Taiwan, South Korea and China. In fact, the lack of cores in 8-inch factories is even more tense. Globally, the production capacity of 8-inch fabs will continue to increase from 2020 to 2024, with an expected increase of 950000 pieces/month, an increase of 17%, reaching a historical record of 6.6 million pieces/month. China's 8-inch factory capacity continues to rise, leading the world. In 2021, 8-inch wafer production capacity in China accounted for 18%, the world's first. In the next five years, China's production capacity will continue to rise.

Last year, China was the world's largest equipment market. Judging from the equipment shipments in the first quarter of this year, China, Taiwan and South Korea are still growing. South Korea of them are even growing at twice the number and increasing the investment in memory.

From the perspective of subdividing the wafer manufacturing equipment market, the WFE market is expected to show steady growth in the next few years. The market size will exceed US $78 billion in 2021 and is expected to exceed US $87 billion in 2022.

After strong growth in 2020, NAND investment will contract some in 2021, but will rebound to $19 billion in 2022; DRAM is expected to increase from $10 billion in 2020 to $15 billion in 2021. As a result, Foundry and Logic fab equipment spending will remain strong throughout the forecast period and is expected to exceed $44 billion in 2021 and 2022.

Whether it is from wafer manufacturing or packaging testing, there has been very rapid growth. The packaging test market is growing even faster than wafer fabrication. The growth of semiconductor manufacturing equipment this year will reach 15%-20% or even higher, and packaging testing will reach about 25%.

Accelerated restructuring of global semiconductor industry chain, China's response

Julong analyzed the plans of the United States, South Korea, the European Union, Japan and other countries for the semiconductor industry chain. In the near future, the investment plan for the semiconductor industry chain includes the US government's $50 billion investment in R & D and manufacturing, and the South Korea plans to invest in 450 billion in the next 10 years. Capital spending by semiconductor companies has increased to record levels this year, with Samsung and TSMC investing $300 billion billion and Intel, Hyex and Micron all stepping up their investments.

Under the background of the global lack of core, China is facing more profound problems such as huge deficit in chip trade, lack of Chinese core and being stuck in the neck. Therefore, it is urgent to improve the self-sufficiency of domestic semiconductors.

Julong pointed out that there is still a gap between the development of China's semiconductor industry and the advanced world, especially in equipment, materials and EDA tools. Taking semiconductor equipment as an example, there is a large gap between supply and demand. "This is a short board, but also an opportunity. Affected by the international situation, the development of the industry ushered in a good opportunity, mainly in the more mature process nodes, in addition to semiconductor equipment, display, photovoltaic and other industries for the growth of the entire domestic equipment have played a good driving role." On the other hand, China's material market is also growing steadily, which is also a good opportunity for domestic enterprises.

The "Several Policies for Promoting the High-quality Development of the Integrated Circuit Industry and Software Industry in the New Era" promulgated by the State Council in August last year includes eight aspects including finance and taxation, investment and financing, research and development, import and export, talents, intellectual property rights, market application standards, and international cooperation. Among them, the key points of research and development policy are to focus on core technologies, promote innovation platforms, and implement national standards. SEMI has been operating in standards for many years and has developed more than 1000 standards and safety-related guidelines in 16 categories, which are widely used in the global semiconductor industry. SEMI is committed to bringing China's industry into the global standard system. It has done this in photovoltaic, successfully bringing China's photovoltaic standards to the world and becoming a global standard.

Julong pointed out that in the face of the current severe challenges, international cooperation and domestic R & D and innovation should go hand in hand, walk on two legs, and play the effect of double circulation. In addition to strengthening and improving the supply chain, innovation chain and capital chain more professional investment, but also pay more attention to the talent chain. The shortage and loss of talents is the core pain faced by semiconductor enterprises, with the rapid development of the industry, the opportunities of science and technology board and the impact of entrepreneurial tide factors, the brain drain of leading enterprises is serious. The competition for talent in the market is fierce, and how to retain and motivate talent is a top priority for the sustainable development of enterprises.

In emerging fields, including power and compound semiconductors and other industries, the domestic prospects are huge. With the help of a strong domestic demand market, it is the hope to take the lead in seeking breakthroughs. SEMI has been exploring the direction and market opportunities of industrial technology in combination with international and domestic industries since it built "SEMI China Power and Compound Semiconductor Platform" in 2018.

SEMI is a global industry association connecting the global semiconductor electronics industry chain. In the past 51 years, SEMI has maintained global membership and win-win cooperation. Adhering to the concept of globalization, specialization and localization, SEMI hopes to play a more active role in China under the current international situation and help the cooperation between domestic and global industries to achieve common growth.

Tianma 2017 Global Supplier Conference Held in Han

2017-04-28

Today, Tianma 2017 Global Supplier Conference was held in Wuhan. The conference gathered 229 partners from Europe, the United States, Japan, South Korea, Taiwan and other countries and regions. More than 400 industry elites gathered together to review the 2016 of Tianma and its global supplier partners and look forward to the 2017.

Service Hotline:

Fax: 86-755-86352266

E-mail:sales@supermask.com

Address: Beiqingyi Opto-electronic Building, Langshan 2nd Road, Nanshan District, Shenzhen City

Copyright © 2025 Shenzhen Qingyi Photomask Limited All rights reserved.